We shared more on DSO.

https://faoblog.com/processes-ar-collections-dso-3/

We had a few nice responses. Chris shared why DSO shortening helps.

https://faoblog.com/processes-ar-collections-dso-3/#comment-1300

He also shared a link to his site on why shortening an AP payment cycle helps companies.

http://insight.cloudxdpo.com/blog/?Tag=early+payment+discount

In the Linkedin group Executive Council on Procure-to-Pay – Bruno asked:

And for DPO What do you use for suppliers credit analysis : DPO with or without monthly countback ? (just accounts payable divided by the cost of sales or for quaterly DPO : Total Quarter purchase / Monthly purchase with Count-back )

The response from Mohit Gupta was:

Hi Bruno, though some organizations do use DPO, I have personally not seen a heavy usage of this parameter. Normally an ageing analysis suffices on the supplier side. DSO helps, since it directly affects the cash position. For payables, it is important to focus on timely payment discounts, so a generalized parameter may not be so effective.

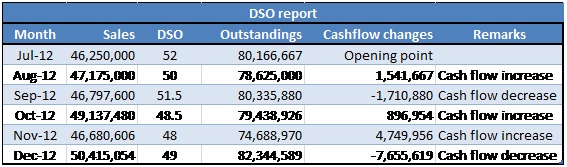

DSO is primarily a number, the number of days. No fancy charts available for reporting the same. You can draw a simple line graph or a bar chart for the month on month number to see its changes.

As you dig a little deeper, you may analyze what led to the change, and again, also report the cashflow generated by this.

Some lessons from this:

- As the sales increase, the collectibles also increase

- Flipside, DSO may not represent correctly, if the underlying presumptions are incorrect.

- A DSO number, if not computed on averages values, may throw up an incorrect analysis.

You may subscribe to the blog from the subscription box on the opening page of the blog. We have enabled a button on the top of the first page, which will enable you share your posts. If you wish to write about any of the current streams, you can do it at https://faoblog.com/guest-post/. We will review your post and release it within 48 hours of your posting.

Trackbacks/Pingbacks