Final accounts – an understanding – Key statements

In the Learning & Development group, on the final accounts series, you read about the Balance Sheet and saw a sample format.

https://faoblog.com/final-accounts-understanding-key-statements-8/

Now, as you saw in the format I shared in the last post, a Balance Sheet has two sides, the assets and the liabilities. In a T form, the liabilities are shown in the first column set and the assets in the 2nd column set. This column signifies the amounts owed by the business entity.

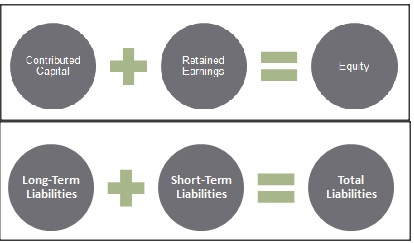

If you remember the basic principles, there was one called “Business Entity”, i.e. the business is separate from its owners. Obviously, the owners have a right to receive back what they contributed to the business. Thus the first major item is the Owner’s funds. These could be in the form of a proprietor’s or partners’ capital contributed, undistributed profit / losses, share capital, both equity and preferential capital.

Then there would be liabilities to external parties for amounts given to the business. These could be short term / long term. Examples can be debentures, loans from bankers / family members, amounts due to vendors, taxes due etc.